Published: July 15th, 2025 • Last Updated: December 6th, 2025

Author: Ross Taylor on AskRoss.ca

Real-Life Example and Practical Advice for Buying a Home After Credit Recovery

I recently received an email from one of our readers, and I thought it would be helpful to share some of the key takeaways from our exchange.

Her situation is one we see more often than you might think. She has completed most of a consumer proposal, rebuilt her credit, and now wants to re-enter the housing market.

Here’s the question she wrote to us:

“I filed a consumer proposal in February 2021. I currently owe about $1,500 and have rebuilt credit with three active credit cards, all in good standing. I also have a car loan through one of the big banks.

I make just under $100,000 a year as an Engineering Supervisor. My father-in-law wants to sell us 30 acres of land with a home already on it, and we’re currently living there.

If I pay off the rest of my consumer proposal this month, what would be my next steps to buy the property?”

This is a great question, and one that touches on a lot of issues around credit repair, alternative lending, and creative real estate solutions like vendor take-back mortgages. Here’s what I told her.

Please note: The name used in this article has been changed to protect our client’s privacy.

Jump to a specific section in this article ↓↓

- Should I pay off my consumer proposal early?

- Can I qualify for a mortgage right away?

- How long does a consumer proposal stay on my credit report?

- Are reporting errors common?

- Why does the location of the property matter to lenders?

- Is a vendor take-back mortgage a good idea?

- How can I rebuild my credit and set myself up for a mortgage?

- How our team will guide you

- Bottom line? Yes, home ownership after a consumer proposal is possible

Should I pay off my consumer proposal early?

Absolutely, yes. If you have the means to pay off your consumer proposal, do it. Right away. The sooner it’s paid off, the sooner the clock starts ticking on credit recovery.

Why does early payoff help with credit recovery?

- It jumpstarts your credit recovery. Your credit bureau report doesn’t start the “cleanup clock” until you’ve made your final proposal payment.

- Once paid off, the proposal will stay on your credit report for three more years.

- That’s potentially years shaved off your credit recovery timeline. And those years matter if you’re planning to apply for a mortgage.

Early payoff doesn’t just help your credit—it can also improve your chances of securing better mortgage terms. This includes lower interest rates, smaller down payments, and more options overall.

↑↑ Back to the list at the top ↑↑

Can I qualify for a mortgage right away?

Rochelle wanted to know if she could buy the property immediately after paying off her consumer proposal.

The short answer: maybe, but not with less than 20% down, and not through a traditional bank.

In most cases, you’ll need to work with an alternative lender, not a big bank or A-lender. These lenders specialize in helping people who’ve had past credit challenges but are now financially stable.

The trade-off is higher interest rates and stricter down payment rules.

↑↑ Back to the list at the top ↑↑

How long does a consumer proposal stay on my credit report?

The good news: a consumer proposal drops off your credit report six years from the date you filed OR three years from the date you paid it off, whichever comes first.

So, paying it off early can significantly speed up your path to a clean report.

What does that mean for you?

- If you pay it off early, it could drop off your report much sooner than expected.

- Once it’s gone, lenders will start to see you as less of a credit risk, especially if you’ve been working to rebuild.

- That opens up the door to more traditional financing options.

Just don’t forget to monitor your credit reports regularly. Make sure everything updates properly.

If it doesn’t, you may need to take action or work with someone who knows how to nudge the bureaus in the right direction.

↑↑ Back to the list at the top ↑↑

Are reporting errors common?

Be warned: errors on credit reports after a proposal are surprisingly common.

Once you make that final payment, both Equifax and TransUnionneed to be updated, and sometimes that doesn’t always happen cleanly.

I’ve seen everything from incorrect dates to entire proposals still showing as active after they were paid off.

Sometimes it takes a professional eye to catch and fix these errors.

If you run into reporting issues or errors, we will connect you with Richard Moxley, who specializes in credit report cleanup and is part of our extended client care team.

↑↑ Back to the list at the top ↑↑

Why does the location of the property matter to lenders?

Rochelle mentioned she’s looking to buy 30 acres with a home on it, and they already live there. I told her the location of the property plays a huge role in whether a lender will approve the mortgage.

Alternative lenders are generally cautious about rural or unconventional properties.

The farther you are from a major urban centre, the bigger the down payment they’ll likely require, and the fewer lenders will be willing to step in.

You’ll likely need a larger down payment, and there may be fewer lenders willing to finance that type of property.

- Unique properties like homes on acreage or converted structures are often considered “non-standard,” which limits your mortgage options.

- Lenders always consider the resale value. If they have to repossess the property, they want to know they can sell it quickly and easily.

↑↑ Back to the list at the top ↑↑

Is a vendor take-back mortgage a good idea?

In Rochelle’s case, since her father-in-law owns the property, there’s a creative solution available: a vendor take-back mortgage (VTB).

That means he, as the seller, would also act as the lender and hold the mortgage on the property himself, at least initially.

This could be a great way to secure the property now, especially if she’s not quite mortgage-ready.

Down the road, once the consumer proposal has fully dropped off her credit and she’s had time to continue rebuilding, she could refinance with a traditional lender, up to 80% of the then appraised value.

When VTBs make sense

- If your credit is still in recovery and you’re not quite ready for traditional financing, a VTB can get you into a home now.

- The seller essentially “loans” you part of the down payment or purchase price, which you repay over time.

- This gives you a chance to rebuild credit while living in your new home, and eventually refinance with a bank or alternative lender once your credit is stronger.

But don’t go into a VTB without legal documentation and advice. It’s a creative solution, but it needs to be done right.

↑↑ Back to the list at the top ↑↑

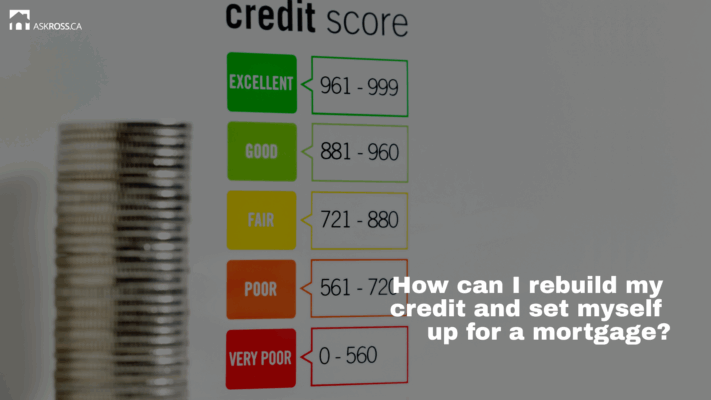

How can I rebuild my credit and set myself up for a mortgage?

Everyone’s path after a consumer proposal looks a little different. But there are a few universal truths I’ve learned from helping Canadians navigate this process:

- Rebuild your credit proactively. Get secured cards, use them wisely, and never miss a payment.

- Save aggressively for your down payment. The more you can put down, the better your options, especially with B-lenders.

- Be honest with your mortgage broker. Transparency helps me find the best lender match for your situation.

- Consider creative solutions. VTBs, co-signers, and non-traditional lenders are tools, not shortcuts.

And remember, this isn’t forever. The right steps now can put you in a position for prime lending within a few years.

↑↑ Back to the list at the top ↑↑

How our team will guide you

Rochelle’s story is specific, but the guidance applies to many Canadians coming out of a consumer proposal.

To help Rochelle take the next steps, I looped in Azie Pouragha, one of our team’s senior underwriters. Azie has extensive experience navigating these kinds of situations and is a fantastic resource for clients rebuilding after credit challenges.

You might be closer to homeownership than you think, especially if you’ve rebuilt credit, have stable income, and can put together a decent down payment.

↑↑ Back to the list at the top ↑↑

Bottom line? Yes, home ownership after a consumer proposal is possible

If you’re willing to put in the work, there’s no reason you can’t buy a home after a consumer proposal. I’ve helped many Canadians do exactly that, and they didn’t have to wait ten years or win the lottery to make it happen.

Early payoff, smart credit rebuilding, and exploring all your options (yes, even the creative ones) are key to getting there.

Whether you’re looking to buy a home today, in a year, or further down the road, we can help you build a game plan.

And if you need support with cleaning up your credit report after a proposal, we’ve got trusted partners for that, too.

Don’t let a past financial setback define your future. Book a call with us and we’ll build a strategy that works for you.

↑↑ Back to the list at the top ↑↑

Ross Taylor Mortgages

If you want great service from someone you can trust – reach out to us today.

Get quick answers to your questions, no matter how difficult – 7 days a week.

Apply For a Mortgage

Apply For a Mortgage