Published: August 22nd, 2024 • Last Updated: August 22nd, 2024

Author: Ross Taylor on AskRoss.ca

What Mississauga Homeowners Should Know About Canada’s Inflation Drop

Hey there, Mississauga! I’ve got some exciting news about the state of our economy. Canadian inflation has finally broken out of the stagnation we’ve seen over the past 13 months and is now at its lowest point in 41 months. Let’s dive into what this means for you and your finances.

The Bank of Canada’s next move | September 4th, 2024

Despite the positive news, there’s a caveat. The monthly change, driven largely by rising gas prices, remains above the pace needed to achieve the Bank of Canada’s 2% inflation target. However, this is unlikely to deter the Bank of Canada from implementing another rate cut in two weeks. Here’s why:

- The ongoing drop in inflation aligns well with the Bank’s forecasts.

- This bolsters the likelihood of a further rate reduction.

- Many analysts anticipate the central bank will lower its key interest rate by 0.25% at its upcoming meeting on Wednesday, September 4th, 2024. Further cuts are possible in October and December this year.

Impact on affordability and purchasing power

When interest rates go up, homebuyers can’t borrow as much money. They have to qualify using the mortgage stress test at 2% higher than the contract rate. This makes it more challenging for some Mississauga residents to break into the housing market or move to a bigger home.

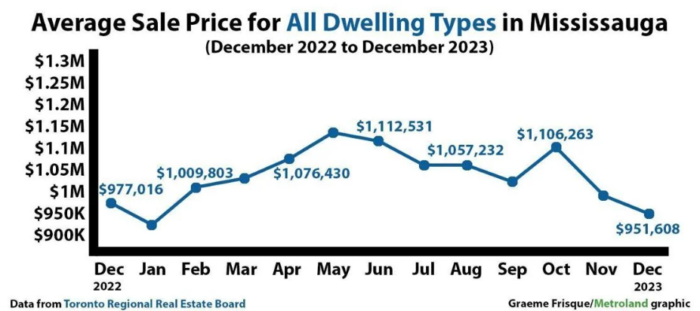

The inevitable result was a drop in prices. For the calendar year 2022, the average cost of a home sold in Mississauga was $1,130,192.

Current Mississauga MLS® stats indicate an average house price of $1,032,416 and 1,105 new listings in the last 28 days.

While higher mortgage rates and inflation have made things challenging for Mississauga homebuyers, the market is showing early signs of adapting and bouncing back. As rates are expected to decrease in the next couple of years, our city’s housing market should pick up steam, but affordability will likely still be a concern.

What is Inflation anyway?

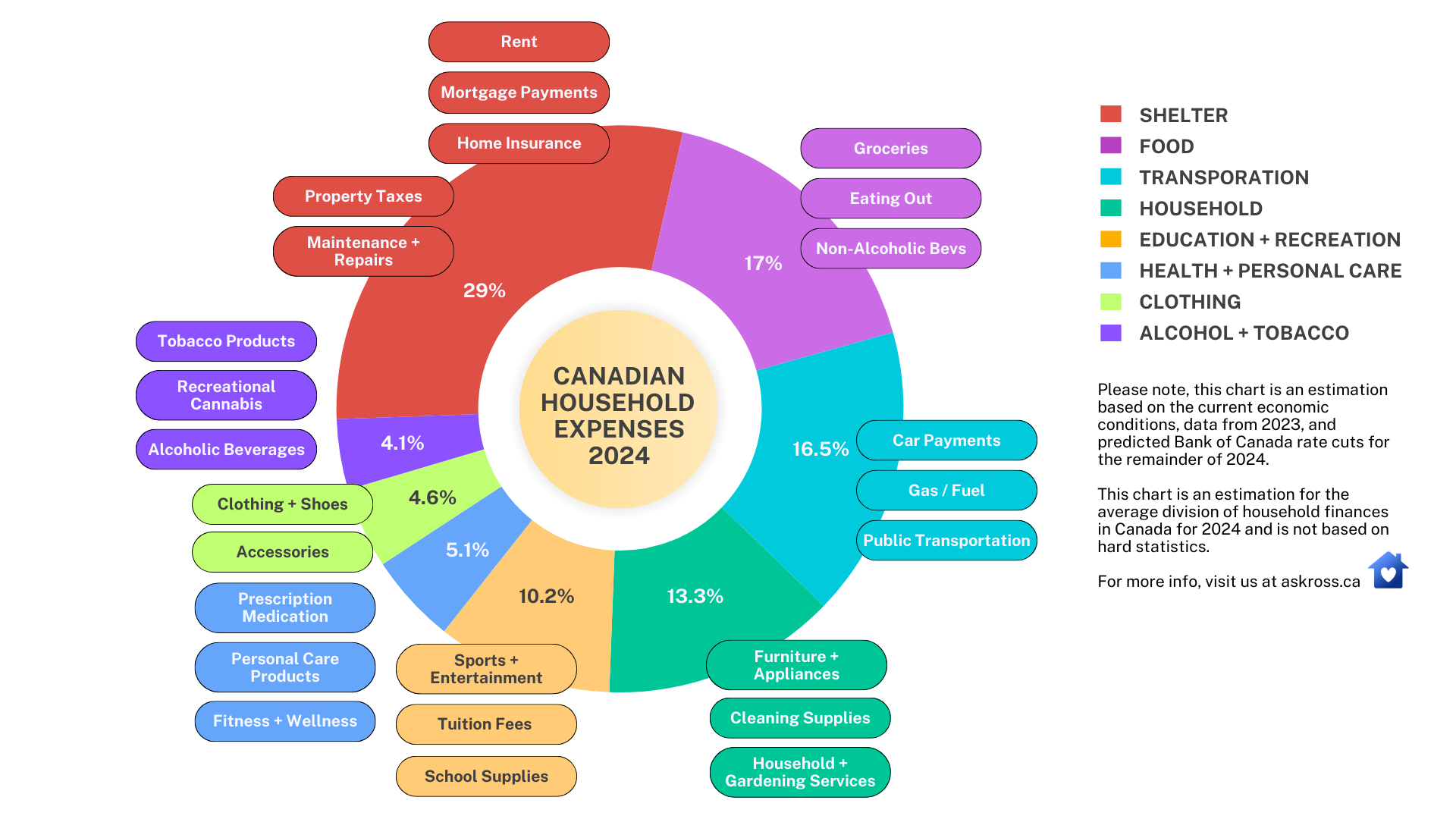

With higher rates, homebuyers must spend a larger chunk of their income on mortgage payments, which makes it harder to afford a home in the city.

Read our latest article on The Basics of Inflation and the Bank of Canada’s 2% Target Rate to understand how inflation works and why the Bank of Canada targets a 2% inflation rate.

There was a shift towards fixed-rate mortgages

Historically, 20% to 25% of all mortgage borrowers have favoured variable-rate mortgages. However,with variable mortgage rates going up so quickly due to the Bank of Canada’s policy rate hikes, almost all borrowers have been choosing fixed-rate mortgages for the past two years.

Homebuyers want to avoid the ups and downs and the shock of higher interest rates. Currently, fixed-rate mortgages have lower rates than variable-rate options, so they remain a popular choice for homebuyers who want predictable monthly payments.

That said, variable-rate mortgages are back in the conversation once again. Some savvy industry professionals insist you will be better off choosing a variable versus a fixed-rate mortgage.In an unofficial poll of mortgage brokers, we note thatthe uptake today is still only around 5% of all applications.

Outlook for mortgage rates and the housing market

Looking ahead, most experts think the Bank of Canada will cut rates by 0.25% from 4.50% to 4.25% at the September 2024 meeting. We’re expecting more rate cuts in 2024 and 2025, which could give homebuyers some relief.

In fact, in our recent article where we cover the forecasted BoC Terminal Rate will end up at somewhere between 2.5% and 3%.

“Terminal Rate” means the bottom rate at the end of the rate easing cycle. Starting from 5% and dropping a total of 2% to 2.5%. Of course, these predictions are not cast in iron, but they are our best guess, given the available data.

As interest rates start to come down, we hope to see home prices and sales in Mississauga go up, thanks to pent-up demand from buyers who have been waiting on the sidelines.

Adapting your home buying strategies

With higher interest rates and the past two years of high inflation, Mississauga homebuyers need to be creative to make their dreams of homeownership a reality. Some of the strategies I’m seeing include:

- Choosing longer amortization periods to lower monthly payments

- Looking into alternative home purchase methods, like rent-to-own or shared equity arrangements

- Looking for help from family in the form of gifted down payments and also co-signing or guaranteeing the mortgage.

- Using digital platforms to find homes and secure low-rate mortgages

Advice From Ross Taylor Mortgages Mississauga

I’m always seeking ways to help my clients navigate the ever-changing economic landscape. Here’s what this news means for you:

-

Potential Savings on Your Mortgage: With the likelihood of more rate cuts, now might be a great time to review your mortgage and see if it makes sense to refinance your mortgage.

-

Increased Affordability: As inflation continues to cool, your dollar may stretch a bit further, especially when it comes to housing and shelter costs.

-

Opportunity for Homeownership: If you’ve been on the fence about buying a home, the combination of cooling inflation and potentially lower interest rates could make homeownership more attainable.

As always, I encourage you to reach out to us with any questions or personalized guidance you need for your unique situation. Our expertise is here to support your real estate decisions in Mississauga’s evolving market. If you have any questions or want to consult with one of our award-winning mortgage professionals, book your free consultation today.

Together, we can assess your current mortgage, discuss potential refinancing options, and ensure you benefit from the most favourable terms available.

Ross Taylor Mortgages

Get quick answers to your questions, no matter how difficult – 7 days a week.

Apply For a Mortgage

Apply For a Mortgage