Published: August 4th, 2022 • Last Updated: August 2nd, 2023

Author: Ross Taylor on AskRoss.ca

What is about to happen to variable rate mortgages?

Most variable rate mortgages have static monthly payments, which protect the borrower’s cash flow from changes to the Prime Rate. Four of the big six banks do this, and so do several credit unions. But a barrage of ten (and counting) Bank of Canada rate increases since March 2 2022 has lead these lenders to increase many of these scheduled payments. This happens when a mortgage’s Trigger Rate and Trigger Point come into play.

This article discusses the impact of all the recent Prime Rate increases on this type of Variable Rate Mortgage.

Jump To

Fixed Rates

Prime Rate Changes So Far

Trigger Rate and Trigger Point

Options When You Hit Your Trigger Rate

What is Your Trigger Rate?

Trigger Rate Calculator

Takeaway and Updates

75% of all Canadian mortgages have historically been fixed-rate

Canadians are typically risk averse and prefer the certainty of a fixed interest rate mortgage payment, which is why fixed rate mortgages usually account for 75% of all mortgages.

But the lure of a static monthly payment, set at 2% lower interest rates than the fixed rate alternative, converted many fixed rate denizens into joining the variable rate fan club for both new mortgages and refinances and renewals. In a recent informal poll of several top mortgage brokers, they cited anywhere from 35% to 45% of all mortgages they have arranged iduring the pandemic era have had variable interest rates.

The fundamental concept of a static payment variable interest rate mortgage is:

The customer’s monthly mortgage payment is not meant to fluctuate when the Prime Rate goes up or down over the life of the loan. This payment style was music to many borrowers’ ears.

That’s the theory, but:

If rates move up in an extreme fashion, as we are seeing now with the benchmark rate, there are circumstances where the lender may ask you to increase your mortgage payment. I will explain this below.

When you accepted your variable interest rate mortgage, it was explained that even though your interest rate varies with changes to the Bank Prime Rate, your repayment would remain fixed over the loan term from when the mortgage was funded. And by and large that has been true; so far.

This approach to your loan payment meant that in a falling rate environment, the amount of principal you repay with each mortgage payment would increase relative to the amount of total interest you pay. In a rising rate environment, the amount of principal you repay with each mortgage payment would decline relative to the amount of interest you pay. This change in principal repaid only affects variable rate loans, not fixed rate loans.

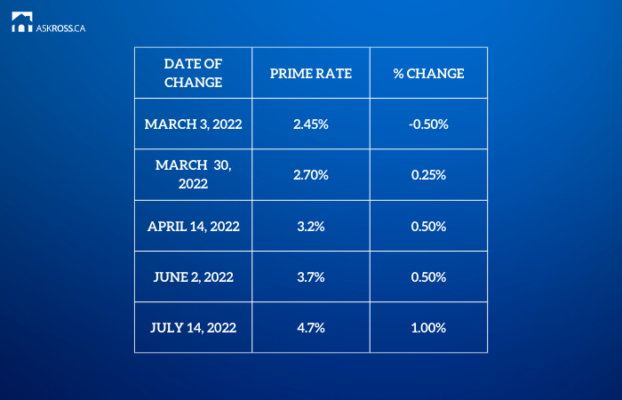

PRIME RATE CHANGES SO FAR SINCE MARCH 2022

Since March 1, 2022, the Bank Prime Rate has increased ten times from 2.45% to 7.2% mainly because the Bank of Canada is determined to bring inflation lower. You can see this in the table below. Things have changed quickly and are unfolding quite differently from the expectations created by the Bank of Canada not so long ago.

We expect the Bank of Canada will continue to raise their key lending rates again this year till they feel they have gotten ahead of inflation. Right now, the official word is the Bank will pause and assess the impact of all these increases. As it does take time to take full effect. Of course, no one can say for certain how much higher Prime will go, but my own view is that rates will resume their upward climb by the summer of 2023.

Please note: If your variable rate mortgage payments go up and down with changes to Prime, then you actually have an Adjustable Rate Mortgage for your repayment term. Given there have been several Prime Rate increases since March of 2022, Adjustable Variable Rate Mortgage borrowers are already reeling from a series of upwards bumps to the size of their scheduled payments.

TRIGGER RATES and TRIGGER POINTS

If your bank’s Prime Rate ever rose to the point where your personal scheduled mortgage payments are only paying interest and not principal, the bank would say you have exceeded your “Trigger Rate.”

If you exceed your personal Trigger Rate, to avoid your mortgage balance owing increasing, the bank will notify you. They typically recommend customers increase the mortgage payment or convert to a fixed rate mortgage to avoid reaching the Trigger Point (defined below). However, no action is required by the customer (and/or cosigner) at this time.

When interest rates increase to the point that regular principal and interest payment no longer covers the interest charged, interest is deferred, and the principal balance (total cost) can increase until it hits the Trigger Point.

Trigger Point is when the outstanding principal amount (including any deferred interest) exceeds the original principal amount.

When this happens, customers are notified, and they can choose from 3 ways to proceed:

1) Make a lump-sum payment against the loan amount.

2) Convert with a new loan at a fixed interest rate term.

3) Increase their monthly payment amount to pay off their outstanding principal balance within their remaining original amortization period.

What is your personal Trigger Rate and Trigger Point?

This is unique to every customer and is given to you in the documents you sign with your lawyer. As my colleague Ron Butler says, “each bank has slightly different Trigger Point definitions and approaches to managing the Trigger Point problem. You have to contact your individual lender and you should!”

How is your Trigger Rate Calculated?

One major bank has told us there is no manual calculation that can be done for customer inquiries.

“Customers can locate their specific trigger rate in the Mortgage Loan Agreement or most recent Mortgage Renewal Agreement they signed. Keep in mind that the Trigger Point is only a point in time and changes quite frequently.”

It is hard to be precise because every mortgage is different and each bank has slightly different Trigger Point definitions and approaches to managing the Trigger Point problem. That said, our colleague Francis Hinojosa, of Tribe Financial Group and a director of Mortgage Professionals Canada, has generously shared a simple but effective calculation which can help you determine your own Trigger Rate.

[CP_CALCULATED_FIELDS id=”6″]

Please note these calculations are approximate and not intended as a basis for financial decisions. You should contact your financial institution to confirm your trigger rate level.

The Takeaway

If you have a variable rate loan and wish to get ahead of this issue, you could consider personally increasing your regular scheduled payment now. The change in repayment plan will be applied directly to the amount of principal owing. There are other repayment options you might explore as well.

Keep in mind if your variable rate mortgage was arranged when the Prime rate was 2.45%, and if you took a thirty year amortization, then there is a very good chance you have already hit your Trigger Rate.

If your mortgage began with a twenty five year amortization, then you may not yet have hit your Trigger Rate.

Update October 28, 2022

The Bank Prime Rate has now increased six times from 2.45% to 5.95% due to the Bank’s attempts to lower inflation rates.

Breaking News – Impact of September 7, 2022 Bank of Canada Rate Hike (updated October 28, 2022)

Update December 07, 2022

The Bank Prime Rate has now increased seven times from 2.45% to 6.45% due to the Bank’s attempts to lower inflation rates.

Breaking News – Impact of September 7, 2022 Bank of Canada Rate Hike (updated December 07, 2022)

My calculations are such that if you have a 30 year amortization and your payment was set when the variable mortgage rates were 1.35% or less, then you would have hit negative amortization somewhere when the actual rate of your mortgage was between 4% and 4.5%.

Borrowers with a 25 year amortization were more likely to hit their Trigger Rate when the actual rate of their mortgage is between 4.9% and 5%.

Today in late January, 2023 even the best variable rate mortgages with the deepest discounts from Prime are now all well past their Trigger Rate.

If you are unsure where you stand, reach out to your bank or loan servicer and find out. And if you feel you are not being given good information, please get in touch with me, and I will do everything I can to help you assess your personal circumstances. You do have choices.

Apply For a Mortgage

Apply For a Mortgage