Published: July 25th, 2024 • Last Updated: September 17th, 2025

Author: Ross Taylor on AskRoss.ca

September 4th Update: Bank of Canada Cuts Rates Again- What It Means for Current & Future Homeowners

The Bank of Canada has cut rates for the second time this year, bringing the policy rate down to 4.5%. This move has significant implications for homeowners and potential buyers. In my latest article, I dive deep into what this rate cut means for you, whether you have a variable-rate mortgage, are considering switching to a fixed-rate, or are in the market for a new home.

I also share insights from top economists on where rates are headed and what factors are influencing these changes. If you want to stay informed and make smart mortgage decisions in this evolving landscape, read the full update here.

Bank of Canada’s July 2024 Rate Cut Explained: Key Insights for Canadian Homeowners & Investors

Big news! On July 24, 2024, the Bank of Canada announced a 25 basis point cut to its policy rate, bringing it down from 4.75% to 4.5%. This decision marks the second rate cut of the year and signals a shift in the central bank’s monetary policy in response to a softening economy and persistent inflation concerns. Here’s what Canadians need to know about this rate cut and its implications.

If you would like to jump to a specific Q&A section in this article, click on any of the items in the list here ↓↓

- What does the rate cut mean?

- Who is affected by the rate cut?

- How will this rate cut affect the Canadian economy?

- What are all of the Bank of Canada’s interest rate announcement dates for 2024?

- How will the rate cut impact variable-rate mortgage holders?

- What is the mortgage stress test?

- How does the mortgage stress test affect borrowers?

- What is the current mortgage stress rate?

- Will the rate cut encourage more homeowners to switch from fixed-rate to variable-rate mortgages?

- What are the factors influencing Canadians to switch from fixed to variable-rate mortgages?

- What is a mortgage renewal?

- Why is renewal the best time to switch or refinance?

- Comparing Refinancing vs. Mortgage Switching

- What are the pros & cons of refinancing my mortgage?

- What are some typical scenarios for refinancing my mortgage?

- What are some typical scenarios for switching my fixed mortgage to a variable-rate mortgage?

- What are the pros & cons of switching to a variable-rate mortgage?

- Key Takeaway: Refinancing vs. Mortgage Switch

- Canadian Market Dynamics & Economists Forecast Future Rate Cuts

- What are economists predicting for rate cuts in 2024 and 2025?

- Advice from Ross Taylor Mortgages

Bank of Canada’s Latest Rate Cut July 24th, 2024

What does the rate cut mean?

The rate cut indicates that the Bank of Canada is attempting to stimulate economic activity by making borrowing cheaper. Lower interest rates generally encourage spending and investment by reducing the cost of loans for consumers and businesses. This move is also a response to slower economic growth, weaker employment and a firm belief the Bank is well on its way to the stated goal of 2% inflation.

Who is affected by the rate cut?

- Homeowners and Homebuyers: Those with variable-rate mortgages and prospective homebuyers will benefit the most. The lower rates can make homeownership more affordable and may stimulate the housing market, though the impact may be gradual. In my view, we need to see more drops than these first two, as the real estate market is a bit skittish these days,

It is quite possible that the Bank of Canada will drop again at its September 2024 meeting, which should act as a catalyst for real estate price stabilization. - Borrowers: Anyone with variable-rate debt, such as personal loans or lines of credit, will see lower interest costs, easing their financial burden. This is because their rates are a function of their Bank’s Prime Rate. Every time the Bank of Canada drops its overnight rate, the chartered banks drop their own Prime Rate.

- Investors: Investors in bonds may see price appreciation as yields fall. Equity markets, particularly sectors sensitive to interest rates like housing and consumer discretionary, may also benefit, though as the saying goes, “one swallow does not mean it’s summer”.

How will this rate cut affect the Canadian economy?

The rate cut is part of a broader strategy to support the Canadian economy. By lowering borrowing costs, the Bank of Canada aims to encourage spending and investment, which can help counteract economic slowdowns and support job creation. However, the central bank remains cautious about lowering rates too quickly, as it could undermine progress in controlling inflation.

Back to the list at the top ↑↑

All of Bank of Canada’s Interest Rate Announcement Dates For 2024

The Bank of Canada announces its policy interest rate on eight fixed dates each year. These dates are crucial for homeowners, investors, and financial markets as they influence borrowing costs and economic conditions.

2024 Interest Rate Announcement Dates:

- Wednesday, January 24th, 2024

- Wednesday, March 6th, 2024

- Wednesday, April 10th, 2024

- Wednesday, June 5th, 2024

- Wednesday, July 24th, 2024

- Wednesday, September 4th, 2024

- Wednesday, October 23rd, 2024

- Wednesday, December 11th, 2024

↑↑ Click the links above to add to your Google Calendar ↑↑

The Bank of Canada’s interest rate announcements on these fixed dates are essential viewing for anyone with a variable-rate mortgage. Understanding these dates helps you anticipate potential changes in your mortgage interest rate and perhaps also your payments which will help you make informed financial decisions.

At the July 24, 2024 meeting Mr. Tiff Macklem (Governor) said “I think what we really tried to signal is that the balance of worries is shifting. For the last two years, we have been most worried about getting inflation down; we’ve made a lot of progress in getting inflation down, it’s not down to two per cent yet, but it’s come a long way back,” he said. “We do need to increasingly guard against the risk that inflation falls too far. We want inflation to come down, but we want it to come down sustainably to two per cent.”

Back to the list at the top ↑↑

Impact of the Bank of Canada Rate Cut on Variable-Rate Mortgage Holders

How will the rate cut impact variable-rate mortgage holders?

All homeowners with variable-rate mortgages will see their interest rates decrease by 25 basis points. This reduction will directly lower the cost of borrowing and, consequently, the monthly mortgage payments.

For instance, a homeowner with a $700,000 mortgage (25-year amortization period) could see their monthly payment drop by approximately $103, translating to approximately $1,240 in annual savings.

1. Fixed Payments with Variable Rates

Four of the top six banks in Canada offer a type of variable-rate mortgage where the monthly payment amount stays the same, but how much of that payment goes toward the principal versus interest changes as interest rates fluctuate.

When interest rates go up, less of your payment goes toward paying down the principal, and when rates go down, more of your payment goes toward the principal.

This approach makes budgeting more predictable because the payment amount doesn’t change, even though the proportion allocated to interest and principal does.

Those with fixed-rate mortgages will not see any change in their payments; that is the nature of a fixed-rate mortgage. However, for borrowers looking for a new mortgage, the overall trend of rate cuts could eventually lead to lower fixed rates in the future, especially if further cuts are anticipated.

In fact, within 24 hours of the BoC’s rate cut, we have already seen some reductions to the 3-year and 5-year rates!

Update July 31, 2024. Government of Canada bond yields have fallen 0.26% over the last eight days. That indicates we can expect even lower fixed rate mortgages. Yesterday we secured 4.64% for a five year fixed rate mortgage on a rental property! That is pretty great. It might have been 6.64% a year ago.

2. Variable Payments with Variable Rates

The other type of variable-rate mortgage is technically called an adjustable-rate mortgage, and for these, the payment will fluctuate with changes to the Prime Rate.

Prime rate is the interest rate that banks charge their most creditworthy customers. It influences the interest rates for various loans and credit products, such as mortgages and personal loans.

When the prime rate goes up or down, it can affect the borrowing costs for individuals and businesses alike, impacting everything from mortgage payments to the cost of financing a new car.

- Other Variable-Rate Loans: Loans such as home equity lines of credit and some student loans will also see reduced interest rates, providing some financial relief to borrowers.

- Savings and Investments: Lower interest rates typically result in lower returns on savings accounts and fixed-income investments, but they can boost the stock market by reducing companies’ borrowing costs.

Trigger Rate Consideration

The trigger rate is the point at which your fixed payment only covers the interest portion of your mortgage. If rates rise above this level, you may need to increase your payments to cover the interest fully and avoid negative amortization.

The Trigger Rate was a hot conversation point when the Bank of Canada increased its overnight rate by 4.75% from March 2022 to July 2023. Now that rates have commenced the reduction cycle, the Trigger Rate will not be discussed that much—at least until rates resume an upward cycle again. Barring a “black swan” event of some kind, we are not expecting that to occur until at least 2026.

What is the mortgage stress test?

When you apply for a mortgage, the lender will look at your finances and use a higher interest rate than the one you’re actually getting to calculate your payments. This “test” rate is usually higher than your actual rate to make sure you can handle potential increases in rates or other financial pressures without falling behind on your mortgage.

The mortgage stress test is essentially a way for lenders in Canada to check if you can still afford your mortgage payments in case interest rates go up or your financial situation changes. Think of it as a safety buffer to ensure you’re not stretching yourself too thin with your home loan.

How does the mortgage stress test affect borrowers?

Despite the lower rates, qualifying for a variable-rate mortgage remains challenging due to the high-stress test rates. Borrowers must qualify at a rate that is typically 2% higher than their actual mortgage rate.

What is the current mortgage stress rate?

As of July 25, 2024, the best variable-rate mortgages we are seeing are at Prime less 1.1%. With Prime at 6.7%, that means a VRM contract rate of 5.6%, which is stress-tested at 7.6%.

The smaller the discount to Prime, the higher the stress test rate. An 8% stress test rate is about average these days.

This high qualifying rate can significantly reduce the amount borrowers are approved for, limiting their purchasing power.

Back to the list at the top ↑↑

Switching From a Fixed Mortgage to a Variable Rate

Will the rate cut encourage more homeowners to switch from fixed-rate to variable-rate mortgages?

Historically, fixed-rate mortgages have been more popular among Canadians due to their stability and predictability. However, there have been long periods when variable-rate mortgages surged in popularity, particularly when they offered significantly lower rates compared to fixed-rate options.

For instance, during the low-rate environment of 2021 and early 2022, variable-rate mortgages accounted for over 50% of new mortgages and renewals!

For the next two years, no one has wanted to even talk about variable-rate mortgages! That is starting to change. These days, one in six new applicants is seriously considering a variable-rate offering. It’s easy to see why since economists agree that we can expect at least another 1.5% in cuts before December 31st, 2025.

What are the factors influencing Canadians to switch from fixed to variable-rate mortgages?

Several factors will determine whether more Canadians will switch from fixed-rate to variable-rate mortgages.

- Interest Rate Differential: As of now, the lowest available high-ratio 5-year fixed rates are around 4.54%, while the lowest variable rates are approximately 5.60%. This spread currently makes fixed rates appear more attractive.However, if further rate cuts significantly reduce variable rates, the differential could narrow, making variable rates more appealing to homeowners and buyers.

- Market Expectations: If the Bank of Canada continues to signal further rate cuts, as predicted by some economists, borrowers can anticipate even lower variable rates in the future. This expectation could encourage a shift towards variable-rate mortgages, which has already started to happen.

- Risk Tolerance: Borrowers’ willingness to switch will also depend on their risk tolerance. Variable-rate mortgages come with the risk of rate fluctuations, which might not be suitable for all borrowers. Those comfortable with potential rate changes and looking to benefit from future rate cuts might consider switching.

That said, we are seeing reluctance from many borrowers who saw the financial upheaval caused by the massive rate hikes from 2022 to 2023.

- Economic Conditions: The broader economic environment, including inflation and employment trends, will influence mortgage decisions. If the economy shows signs of stability and continued rate cuts, more borrowers might be inclined to opt for variable rates.

As it stands, fixed-rate mortgages will remain the preferred choice due to their current lower rates and stability, but continued rate cuts could create some new variable rate disciples. My own view though is that the majority of Canadians will prefer a fixed rate mortgage, no matter what. Prior to the pandemic, roughly 75% of Canadians chose a fixed rate mortgage, so I am not really going out on a limb!

While the recent rate cut by the Bank of Canada makes variable-rate mortgages slightly more attractive, a significant shift from fixed-rate to variable-rate mortgages will depend on several factors, including the extent of future rate cuts, the interest rate differential, and individual borrowers’ risk tolerance.

Back to the list at the top ↑↑

Mortgage Renewal: The Best Time to Switch or Refinance

What is a mortgage renewal?

A mortgage renewal occurs when the term of your current mortgage ends, and you need to sign a new agreement to continue paying off your mortgage. In Canada, mortgages typically have terms ranging from one to five years, sometimes longer. At the end of each term, unless you pay off the remaining balance in full, you must renew (or renegotiate) your mortgage for another term.

Why is renewal the best time to switch or refinance?

1. Avoiding Penalties

- No Prepayment Penalties: Renewing at the end of your term allows you to avoid the prepayment penalties that come with breaking a mortgage mid-term. These penalties can be substantial, especially for fixed-rate mortgages.

- Cost Savings: By avoiding these penalties, you save thousands of dollars that would otherwise be spent on fees, making it a cost-effective time to switch or refinance.

2. Opportunity to Negotiate

- Better Rates: Renewal time is an excellent opportunity to negotiate a better interest rate with your current lender or shop around for a more competitive rate from a new lender.

We always encourage our clients and anyone in need of advice regarding their renewal to reach out to us regarding the renewal terms they are being offered. We will gladly tell you if the offer in hand is as good as can be or if there is room for improvement. - Improved Terms: With an experienced mortgage professional by your side, you can also negotiate other terms, such as payment frequency, amortization period, and additional features like prepayment privileges.

3. Assessing Your Financial Situation

- Review Financial Goals: Renewal is a natural time to reassess your financial goals and needs. You can decide whether to increase payments to pay off your mortgage sooner or adjust terms to better fit your current financial situation. If you choose to lengthen your amortization period, your monthly payments could be reduced.

To be frank, we are seeing at least half our renewal files extending their amortization period from 25 years to 30 years in order to reduce the impact of the new rate – which in practically every case is markedly higher than the rate which is renewing.

To help illustrate that point, our clients whose mortgages are maturing in the fall of 2024 have current rates around 2.69% to 2.79%, so you can understand how things have changed dramatically. - Debt Consolidation: If you have high-interest debts, refinancing at renewal can allow you to consolidate these debts into your mortgage, almost certainly lowering your overall interest costs substantially AND giving you a single low payment to manage, instead of the minimum payments required by credit cards and personal lines of credit.

4. Flexibility to Switch Lenders

- Shopping Around: You are not obligated to renew with your current lender. Renewal time is an ideal moment to explore offers from other lenders, which might provide better rates or terms. Your mortgage broker can readily do that for you, with access to dozens of prime lenders.

In fact, you would be crazy not to shop around at this time. Many people simply sign on the dotted line at renewal time because it is so convenient, but they may be leaving thousands of dollars on the table. - No Stress Test for Insured Mortgages: If your mortgage is insured, you can switch lenders without undergoing a new stress test, simplifying the process and enhancing your chances of qualifying for the lowest rates and smallest payment!

Back to the list at the top ↑↑

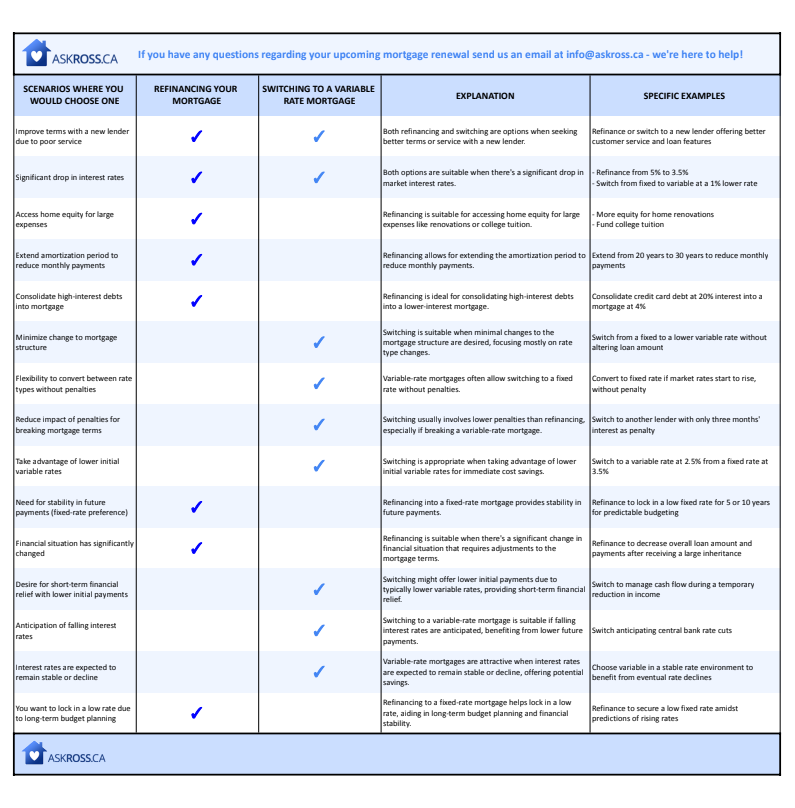

Comparing Refinancing vs. Mortgage Switching

If you’re considering updating your mortgage terms, it’s important to know the differences between refinancing and switching to a variable-rate mortgage. In this detailed comparison table, we’ve broken down the key aspects, similarities, differences, pros, cons, and typical scenarios for each option.

Whether your objective is to lower monthly payments, access equity, or secure a more favourable rate, this table provides the essential information to confidently navigate your choices. Click on the image below to download the PDF table.

Back to the list at the top ↑↑

Refinancing Your Mortgage: Everything You Need To Know

What are the pros & cons of refinancing my mortgage?

Refinancing your mortgage can provide significant financial flexibility and savings, allowing for more favourable terms that better suit your current financial situation. However, it’s essential to carefully consider whether the long-term savings outweigh the upfront costs.

Potential pros of refinancing your mortgage:

1. Access Home Equity

- Refinancing allows you to access the equity in your home for renovations, debt consolidation, or other financial needs. A significant percentage of our equity take-out refinances used to be for renovations and possibly to extract money for a down payment on an investment property.

However, with the high mortgage rates we now have, we see the main reason our clients refinance these days is for debt consolidation. Think about this. If you have $30,000 in credit card debt with an interest rate of 19.99%, it seems like a no-brainer to convert this debt into a 5% mortgage. The monthly payment will be ⅓ of the amount you are currently paying.

2. Change Loan Structure:

- You can adjust the loan amount and term length, and switch from fixed to variable rates or vice versa, just as long as you qualify under current lending guidelines.

Potential cons of refinancing your mortgage:

1. Fees & Costs

- Refinancing typically involves legal fees, appraisal fees, title insurance and possibly other administrative costs. These will typically be around $2,000 to $3,000 in total.

2. The Mortgage Stress Test:

- If you refinance with a new lender or your current lender, you will need to pass a new stress test.

What are some typical scenarios for refinancing my mortgage?

A few years ago, refinancing was often advantageous when looking to lock in a lower interest rate for the long term, as this could substantially reduce the cost of borrowing. In the current climate, most homeowners will not be refinancing to a lower interest rate—rather, the contrary.

Additionally, accessing home equity can provide necessary capital for significant expenses without relying on higher-interest credit options.

1. Interest Rate Changes:

- When interest rates have dropped significantly, it is beneficial to secure a lower rate.

- Example: “Interest rates have dropped by 2%, and I want to reduce my monthly payments significantly.”

2. Accessing Your Home Equity:

- When you need funds for renovations, debt consolidation, or other financial needs.

- Example: “I need $50,000 for home renovations and want to use my home equity.”

3. Changing Your Loan Structure:

- For example, re-amortizing your mortgage back to, say, 25 years or even 30 years can reduce the new mortgage payment considerably and lessen the impact of refinancing into a higher-rate environment.

Other homeowners have had enough of the variable rate mortgage experience, and even though it may now be a good time to take a variable rate mortgage, they want nothing to do with that. So they may want to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage for stability.

- Example: “I want to switch from a variable-rate to a fixed-rate mortgage for more stability.”

Back to the list at the top ↑↑

Switching to a Variable-Rate Mortgage: Everything You Need To Know

What are some typical scenarios for switching my fixed mortgage to a variable-rate mortgage?

Switching to a variable-rate mortgage can be a strategic financial move when market conditions favour lower variable rates, offering cost savings and greater flexibility. However, it’s crucial to assess the economic climate and future rate expectations before making a decision to switch your mortgage from a fixed rate to a variable or adjustable rate.

1. Better Interest Rates:

- When you find a lender offering a lower variable rate compared to your current fixed rate.

- Example: “I found a lender offering a 0.5% lower rate, and I want to switch to save on interest.”

2. Minimal Alterations To Your Mortgage Terms:

- When you want to benefit from lower rates with minimal changes to your mortgage terms.

- Example: “I want to switch to a variable rate to take advantage of potential future rate cuts, but I don’t need to change my loan amount or term.”

3. End of Mortgage Term:

- When your mortgage term is ending, and you want to switch to a lender with better rates or terms.

- Example: “My mortgage term is ending, and I want to switch to a lender with better customer service and lower rates.”

In our experience, most homeowners who switch from fixed-rate mortgages to variable rates do so because they are not fearful of rate increases and believe rates are heading down. It’s important to mention that they will also retain the option to convert their variable rate mortgage to a fixed mortgage at any time during the five-year term.

This is a key feature of all variable-rate mortgages. You can switch (ONCE) to a fixed-rate mortgage with no fees or penalties. However, you cannot switch from a fixed-rate mortgage to any type of variable-rate mortgage mid-term unless you are prepared to incur prepayment penalties and other fees.

What are the pros & cons of switching to a variable-rate mortgage?

Switching to a variable-rate mortgage offers the advantage of greater adaptability in an evolving economic landscape. However, the inherent risk of variable interest rates requires strong financial planning to accommodate possible increases in future payments.

It is also only for people who know themselves well enough to handle the stress of interest rate fluctuations.Even seasoned homeowners like your author experience pangs of angst when rates increase, and the adjustable-rate mortgage payment goes up.

Potential pros of switching your mortgage:

- Potential Lower Rates: Variable rates can offer lower, subsequent interest rates if the Prime Rate decreases, compared to fixed rates, leading to immediate savings in the form of a reduction of the interest expense.

- Flexibility: Variable-rate mortgages often provide more flexible terms and the ability to convert to a fixed rate without penalties. However, you cannot convert to a variable-rate mortgage from a fixed-rate mortgage.

Potential cons of switching your mortgage:

- Rate Fluctuations: Monthly payments can increase if interest rates rise, leading to potential financial instability.

- Uncertainty: The unpredictability of rate changes can make budgeting more challenging and stressful. This is probably why only 25% of Canadians choose a variable-rate mortgage in normal economic times.

Back to the list at the top ↑↑

Key Takeaway: Refinancing vs. Mortgage Switch

When your mortgage renews at the end of its term, this is generally the best time to either switch or refinance your mortgage.

Timing a change to your mortgage with your renewal allows you to avoid penalties, negotiate better rates and terms, and reassess your financial situation without the added costs and complexities associated with breaking your mortgage mid-term.

Understanding these benefits can help you make informed decisions to optimize your mortgage and financial health. As always, we recommend speaking with a mortgage professional as soon as possible. An experienced professional will guide you through the process and negotiate the best terms for you.

If your mortgage pro is a broker, s/he will have access to dozens of AAA lenders who can best match your circumstances. Why settle for only one choice?

Back to the list at the top ↑↑

Canadian Market Dynamics & Economists Forecast

Variable rates, even after the cut, are still higher than most fixed mortgage rates (3-year or longer terms) available in the market today. Fixed rates are currently around 5%, making them more attractive to many borrowers. Until variable rates fall further, they may not provide a more affordable option compared to fixed rates.

That said, my own view is that if we look ahead to two years from now, those who choose a variable rate mortgage today will be ahead of those who chose a fixed rate mortgage.

Watch for a sign of further rate cuts at the September 4th, 2024, Bank of Canada meeting and pay close attention to the USA Federal Reserve. When the Fed starts cutting, that is a bullish prod for further cuts in Canada.

The Fed may initiate its first rate cut at its mid-September meeting. As Morning Star reported, “The Fed will pivot to monetary easing as inflation falls back to its 2% target and the need to shore up economic growth becomes a top concern.”

Central Banks typically continue to cut rates once the cutting begins.

What are economists predicting?

Economists predict more rate cuts are on the horizon if inflation continues to ease and economic conditions warrant further easing. This means no “black swan” events, which could throw chaos into current thinking.

Further rate cuts could provide additional relief to borrowers and further stimulate economic activity, but the Bank of Canada will closely monitor economic indicators to guide its future decisions.

- Potential for Future Cuts: Economists predict more rate cuts could be on the horizon if economic conditions warrant further easing. This could eventually make variable-rate mortgages more competitive relative to fixed rates.

- Housing Market: While the July 24, 2024 rate cut provides some financial relief, it may not be sufficient by itself to significantly stimulate the housing market. High home prices and economic uncertainties continue to pose challenges for potential homebuyers. However, the rate cut could offer some optimism and potentially increase real estate demand in the near future.

- Consumer Confidence: The Bank of Canada’s rate cut is a positive signal indicating efforts to support the Canadian economy. This may boost consumer confidence slightly, encouraging some buyers to re-enter the market.

For variable-rate mortgage holders, the Bank of Canada’s rate cut translates to immediate savings and reduced interest costs. However, the broader impact on the housing market and mortgage qualification remains complex, influenced by Canada’s high-stress test rates and overall economic conditions.

What can Canadians expect for future rates?

The recent rate cut by the Bank of Canada is a significant move aimed at bolstering the economy. It provides immediate benefits to those with variable-rate debt and potential long-term advantages for the housing market and broader economic growth.

Based on the latest data and expert predictions, interest rates in Canada are expected to decrease through 2024 and into 2025.

Steve Huebl from Canadian Mortgage Trends reports:

“An economy sitting at full employment and on-target inflation will in theory be one requiring interest rates to be at a neutral setting, which the Bank (and CIBC) see at 2.75%,” noted CIBC’s Avery Shenfeld. “Barring an economic shock, that’s a reasonable forecast for where 2025 will end up.”

Shenfeld adds that the Bank will likely take its time in the current easing cycle, with rate pauses dotted in between the rate cuts, particularly in response to economic data that may give the Bank of Canada reason for pause.”

Here’s a detailed look at the forecasts and what they mean for homeowners considering switching from a variable-rate to a fixed-rate mortgage.

What is the interest forecast for the rest of 2024?

The general consensus among the Big 6 Banks in Canada is that interest rates will continue to decrease throughout 2024. Predictions indicate an overall reduction of 75 to 100 basis points by the end of the year.

The Bank of Canada overnight rate peaked at 5% in the summer of 2023. Today, July 25th, 2024 that rate now sits at 4.5%.

Bank-Specific Predictions of the Bank of Canada Overnight Rate :

- BMO: 4.25% by Q4 2024

- CIBC: 4.00% by Q4 2024

- National Bank: 4.00% by Q4 2024

- RBC: 4.00% by Q4 2024

- Scotiabank: 4.00% by Q4 2024

- TD: 4.25% by Q4 2024

Back to the list at the top ↑↑

Are interest rates expected to climb in 2025?

No, in fact, rates are expected to continue decreasing into 2025, with forecasts suggesting a gradual reduction of the Bank of Canada overnight rate to around 3.0% by the end of the year.

Bank-Specific Predictions of the Bank of Canada Overnight Rate:

- BMO: 3.50% by Q4 2025

- CIBC: 2.75% by Q4 2025

- National Bank: 3.00% by Q4 2025

- RBC: 3.00% by Q4 2025

- Scotiabank: 3.25% by Q4 2025

- TD: 2.75% by Q4 2025

What are the economic factors influencing rates?

- Inflation: The Bank of Canada is confident inflation will continue to move towards its 2% target, which supports the case for rate cuts.

- Economic Growth: The GDP growth forecast for 2024 has been trimmed, indicating a weaker economy, which typically leads to lower interest rates to stimulate growth.

- Geopolitical Risks: Any increase in geopolitical risks could add to inflationary pressures, potentially impacting the rate cut trajectory.

Sources:

- https://www.nesto.ca/mortgage-basics/mortgage-rates-forecast-canada/

- https://www.reuters.com/markets/rates-bonds/bank-canada-cuts-rates-again-frets-about-low-growth-2024-07-24/

- https://altrua.ca/canada-interest-rate-forecast/

- https://wowa.ca/interest-rate-forecast

- https://www.bankofcanada.ca/2024/07/fad-press-release-2024-07-24/

- https://economics.td.com/ca-long-term-forecast

- https://vancouversun.com/news/local-news/bc-homeowners-interest-rates-forecast

Back to the list at the top ↑↑

Should I switch to a fixed-rate mortgage?

Given the current forecasts, it might not be immediately advantageous to switch from a variable-rate to a fixed-rate mortgage if rates are expected to decline. However, there are scenarios where switching could still be beneficial. Payment certainty is a big factor, and so is your ability to cope with a fluctuating mortgage interest rate. That is not everyone’s cup of tea.

Based on the current forecasts, interest rates in Canada are expected to decrease through 2024 and into 2025. While this generally makes variable-rate mortgages more attractive, individual circumstances such as budget constraints, risk tolerance, and economic outlook should guide your decision.

Back to the list at the top ↑↑

Advice from Ross Taylor Mortgages

Canadians should stay informed about future rate changes and consider how these shifts might impact their financial decisions. We publish a comprehensive and informative newsletter every month. Our goal is to keep our clients, and readers informed about what is going on out there and also what we see coming down the pike. These letters are read by thousands of Canadians each month.

Read July’s newsletter here.

As always, we’re here to help. If you have any questions or want to consult with one of our award-winning mortgage professionals, book your free consultation today.

Ross Taylor Mortgages

We provide personalized advice based on your specific situation and the latest market conditions. If you want great service from someone you can trust – reach out to us today.

Get quick answers to your questions, no matter how difficult – 7 days a week.

Apply For a Mortgage

Apply For a Mortgage