Published: August 3rd, 2023 • Last Updated: October 3rd, 2024

Author: Ross Taylor on AskRoss.ca

What should you do with your variable rate mortgage?

Updated October 3, 2024

The good news is if you already have a variable rate mortgage, you have experienced three rate cuts of 0.25% since June 2024 till September 2024.

And experts are forecasting a 50% chance of a 0.5% cut following the October 23, 2024 Bank of Canada Meeting.

There will be one more BoC meeting on December 11, 2024. I feel reasonably confident between these two remaining meetings in 2024, that the Prime Rate will drop a further 0.75% in total.

Of course, all of this is a best guess. Any major “black swan event” such as a major war in the Middle East could change things.

I think if you are in a variable rate mortgage and content to “ride the wave” downwards, keep an eye on five year fixed mortgage rates. If they get below 4%, that may be a prudent time to convert from a variable rate to a fixed rate mortgage.

Originally published in Fall 2023:

Let’s face it, the past year or so has been a miserable experience for everyone with a variable rate mortgage. Before the first of ten increases to the Prime Rate last March, variable mortgage rates were around 1.5%. And now they are all over 6%.

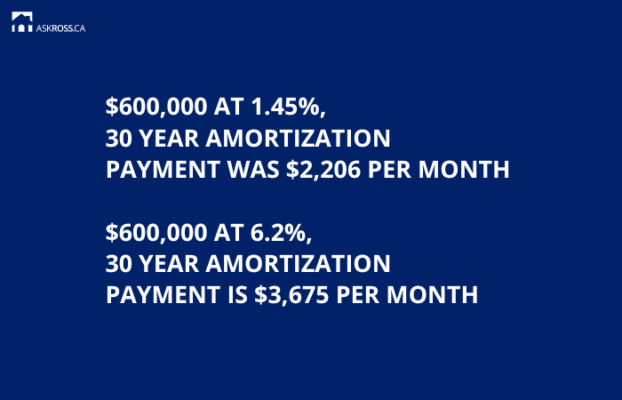

If your mortgage is the type where the payment increases with each rate bump, you’ve seen your payments increase by nearly 80%. For example:

And if your mortgage is of the static payment variety, if you did not voluntarily increase your payment, nor make a substantial lump sum payment, then unfortunately your mortgage balance owing is now increasing every month!

This is because you have probably hit your Trigger Point and every dollar you pay is to pay interest.

The question is what to do, right now?

It’s important to understand when rates start to decline, fixed rates will fall first, and variable rates will fall later. The reason is the Bank of Canada governor will want to be certain they have truly wrestled inflation to the ground prior to dropping their key overnight rate.

But fixed rate mortgages rates are more driven by Government of Canada bond yields, and they act as a form of leading indicator of where the BoC is headed. So they typically act in advance. We saw this in late 2021 and early 2022 when fixed mortgage rates rose even as their variable rate cousins flourished around the 1.3% mark.

Some of you transitioned over to a fixed-term mortgage at some point, but some have not.

Some people may give up on home ownership and list their property for sale. They figure it will be cheaper to rent than to own. We have seen a few instances of this already.

Switching to a fixed-rate mortgage at this time does not look like a great choice. For most term choices the rates start with a 6, even for two and three-year terms.

If this is something you want to consider, you can avoid a penalty by staying with your current lender. If you switch lenders to get a better rate, you will be dealing with a 3 months interest prepayment penalty as well as legal and appraisal fees.

So the rate difference has to be compelling to warrant changing lenders. Ask us if you are not sure.

And as painful as it has been, if you have not taken any action to date, you might be best hanging tough a while longer. Maybe you will have a chance to switch to a more favorable fixed-rate mortgage in the new year

Apply For a Mortgage

Apply For a Mortgage